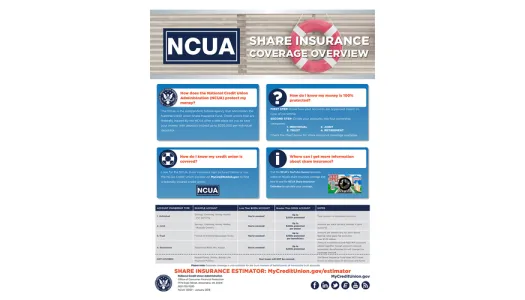

Descripción general de la cobertura de seguro de depósitos

How does the National Credit Union Administration (NCUA) protect my money?

The NCUA is the independent federal agency that administers the National Credit Union Share Insurance Fund. Credit unions that are

federally insured by the NCUA offer a safe place for you to save your money, with deposits insured up to $250,000 per individual depositor.

¿Cómo sé si mi dinero está 100% protegido?

PRIMER PASO: Sepa cómo se organizan sus cuentas según el tipo de titularidad.

SECOND STEP: Divide your accounts into four ownership categories:

- INDIVIDUAL

- JOINT

- TRUST

- RETIREMENT

Check the chart below for share insurance coverage examples.

| ACCOUNT OWNERSHIP TYPE | EXAMPLE ACCOUNT | Less Than $250k ACCOUNT | Greater Than $250k ACCOUNT | NOTES |

|---|---|---|---|---|

| 1. Individual | Ahorros, corriente y Money Market: solo para uso personal | You’re covered! | Up to $250k protected | Monto total en cuentas combinadas |

| 2. Conjunta | Cuenta de ahorros, Cuenta corriente, Money Market - varios titulares | You’re covered! | Proteja hasta $250,000 por titular | Monto por el interés de cada titular en cuentas conjuntas |

| 3. Fideicomiso | Fideicomisos revocables formales o informales | You’re covered! | Hasta $250,000 protegidos por beneficiario | Amount per beneficiary, for each owner. Special rules apply for accounts over $1.25 million |

| 4. Retirement | Traditional/Roth IRA, Keogh | You’re covered! | Up to $250k protected | Se suma el importe de las cuentas IRA tradicionales e IRA Roth. Las cuentas Keogh son aseguradas aparte. Los beneficiarios no cambian el monto de la cobertura. |

| NOT COVERED | Mutual Funds, Stocks, Bonds, Life Insurance Policies | Your losses will NOT be covered. | Your losses will NOT be covered. | El Fondo de seguro de depósitos NO cubre las pérdidas de este tipo de cuentas y fondos. |

Please note: Separate coverage is also available for the trust interests of beneficiaries of irrevocable trust accounts

Share Insurance Estimator:

MyCreditUnion.gov/protect-your-money/share-insurance/share-insurance-estimator